Compare with 60+ lenders

Easy credit card application

Instant credit limit approval

Get 60+ credit card offers and apply online on Yoindi. Yoindi is a platform where you get information on features, benefits, fees, and the latest offers on the credit card, and you can apply for the best options.

A credit card is a mode of payment where a cardholder makes the payment for goods and services. Credit card is a cashless transaction. The credit card cardholder has to make payments according to his credit limit. A person credit limit depends on credit score, income, and credit history.

The cardholder must repay the money to the issuer before the due date. Otherwise, you need to pay interest on late payments.

| Credit Card | Category | Features | ||

|---|---|---|---|---|

|

Axis Bank Vistara Platinum Credit Card | Travel and Lifestyle | Complimentary Club Vistara Membership, Priority check-in, and excess baggage allowance | Apply Now |

|

Axis Bank Vistara Infinite Credit Card | Travel and Lifestyle | Complimentary lounge access cardholders can enjoy access to domestic and international lounges at airports across India. | Apply Now |

|

Axis Bank Select Credit Card | Frequent Travelers | Travel benefits - cardholders can enjoy discounts on flight bookings and hotel stays through MakeMyTrip. | Apply Now |

|

Axis Bank Privilege Credit Card | Shopping and Movies | Discounts and offers on dining, shopping, and travel. | Apply Now |

|

Axis Bank My Zone Credit Card | Shopping and Entertainment | Discounts on dining, shopping, and entertainment. | Apply Now |

|

Axis Bank Magnus Credit Card | Lifestyle and Entertainment | 5% cashback on movie tickets, complimentary subscription to Amazon Prime for one year. | Apply Now |

|

IndianOil Axis Bank Credit Card | Gas and petroleum expenses | Up to Rs.250 on all fuel expenses made within 30 days of card issuance. | Apply Now |

|

Flipkart Axis Bank Credit Card | Online shopping | 5% in flipkart and Myntra, 4% for selected merchants. | Apply Now |

|

IndusInd Platinum Card | Fee Waiver | Avail travel insurance and protect you from fraudulent transactions | Apply Now |

|

SBI Card Elite | All Round Benefits | Welcome e-gift voucher worth Rs 5,000 | Apply Now |

|

HDFC Freedom Card | Reward Points | Everything from grocery shopping to movie and dining reservations to train and taxi reservations | Apply Now |

|

Axis Bank Neo Credit Card | Shopping and Movies | It offers benefits such as dining, shopping, and entertainment | Apply Now |

|

InterMiles HDFC Bank Signature Credit Card | Travel | Up to 12 intermiles. Spent Rs 150 on flight and hotel bookings | Apply Now |

|

HDFC Dinners Club Privilege | Travel and Lifestyle | Complimentary Annual Memberships of amazon prime, Times prime, and more | Apply Now |

|

Amazon Pay ICICI Credit Card | Online Shopping | 5% cashback on Amazon purchases for Prime Users | Apply Now |

|

RBL Bank Shoprite Credit Card | Rewards Points | You can earn 1000 rewards point every month | Apply Now |

|

RBL BankBazaar SaveMax Credit Card | Rewards Points | Get instant funds into the bank through Xpress Cash Facility | Apply Now |

|

Yatra SBI Credit Card | Travel, flight booking, and hotel booking | You get access to airport lounges in India | Apply Now |

A bank or credit union enters into an agreement with the merchant where they ask them to accept their credit cards. They accept credit cards by displaying their logos.

A person applies for a credit card from banks and credit unions. When banks and credit unions approve it, they become credit card holders. The credit card holder can make payment for goods and services in the place where credit card payment mode is accepted.

When the payment is made through a credit card, the person must repay the money before the due date. If you do not repay the money on time, you must pay interest. You can make payments online or offline.

+2 more

+2 more

+2 more

+2 more

+2 more

+2 more

Below are the top 12 features of a credit card once should look for.

Many credit card providers offer welcome bonuses such as extra rewards, cash back, points, or miles when you use a credit card. To get the bonus, you must reach a minimum spending requirement when opening the account.

Rewards points are the points a credit card holder receives when purchasing. When you purchase a high amount of goods and services, you earn high points, while low purchases earn low points. For example, you earn more rewards when you buy flight tickets than grocery items.

You have not been charged when spending on petrol or diesel and paying with a credit card. This process is considered a fuel surcharge waiver.

It is the simplest form of benefit a credit card holder receives. When they spend money, they receive cash back. There are few banks and credit card providers which offer you cashback on credit cards.

When you are looking for a credit card that benefits you in a major area of your life, go for a lifestyle credit card. It provides you with the following benefits:

When you have a travel credit card, you save money while traveling. You will be wondering how you save money and let know the benefits.

An airport lounge is where you can stay comfortable if you reach before the time. There are two types of the lounge: Domestic airport lounge and complimentary airport lounge. You will not get a complimentary lounge easily. You should be a member or pay a fee to stay in a complimentary lounge. But when you get access to a complimentary lounge with a credit card, then you get various benefits for free.

An add-on credit card contains the same features as a primary credit card. The card is availed to the family members. The credit card issuers provided 2-3 cards for free, where there is no joining fee or annual fee. This reduces annual maintenance costs as you do not need multiple credit cards.

You will get personal accident coverage and travel insurance coverage benefits with a credit card. It makes credit cards attractive.

Credit cards are accepted globally as the mode of payment. Visa and Mastercard accept cards for payment around the globe.

With a credit card, you can convert your purchase into EMI. After converting the purchase into EMI, you can make payments in installments according to your convenience. Paying through the EMI is easier than taking a personal loan to buy a Refrigerator and television.

Credit card is not only useful for shopping, but it helps in improving credit score. When you repay the amount on time, your credit score increases, and you can obtain loans at a difficult time.

There are 7 main types of credit card.

It is a popular category in credit cards because it is useful to every age group. You can apply for a shopping credit card online on the bank website and YoIndi.

There are three types of Shopping Credit Cards.

The cards provide benefits to you when you spend on lifestyles. These cards offer rewards, discounts, and other benefits on shopping, dining, health benefits, traveling, and insurance coverage.

The top 5 lifestyle credit cards are as follows:

You can save money on fuel purchases with Fuel Credit Cards. The annual fees of these cards are 0 to Rs 1000. The interest charged on fuel credit cards is 3.25% - 3.40%. It provides benefits in other categories, such as dining, shopping, and entertainment.

When you spend with credit cards, you receive rewards that you can redeem. You can spend on popular places like online and merchant store shopping, travel, dining, etc., and earn rewards points.

Are you looking for a credit card where you are not receiving rewards but receiving cashback? Because when you receive real money, you can spend it on other items, which is better than getting rewards. You can look into different credit cards and choose cashback credit cards.

Travel credit cards offer exciting deals for traveling. When you have these credit cards, you save a lot of money. They provide you with travel insurance, complimentary airport lounge access, an Annual fee waiver, and zero liability on lost card benefits.

Do you like to watch movies in Cinema? There came a recuse for your Entertainment Credit Cards. It saves you money on movie tickets as well as dining. Certain banks give the dining facility. You have to check it before applying.

You need the following documents to get the credit card

The eligibility criteria to get a credit card are given as follows:

While you are applying for a credit card, you must be aware of its charges as you must bear them. The followings are the fees you have to bear as a credit card holder:

Overlimit Charges arise when you make a transaction above your credit card limit. It is a penalty for you, so you do not make the same mistakes. The charges depend on the terms and conditions of the credit card agreement.

The charges that credit card holders have to pay on outstanding amounts. Such situations arise in the following ways:

Most banks charge 2% to 4% interest on outstanding amounts.

When cardholders do not pay the due on time, additional charges levied on him/her are called late payment fees. This is a flat fee amount not dependent on interest charges.

The charges you have to pay annually after getting a credit card. If the bank provides free credit cards, the joining fee and annual charges for one year are waived. Check with your credit card provider that the annual maintenance charge is waived for a year or lifetime.

When you make any transaction overseas using a credit card, you must pay an International transaction fee. The fee is around 1% - 3% or more and is converted into rupees when you have to pay. The foreign charge on MasterCard and visa cards is a fee of 1%.

Are you wondering what type of international transaction then following place International transaction fee is charged?

Yes, you can use a credit card to withdraw cash from ATMs. These are additional benefits the banks give, but you have to withdraw the amount according to your credit limit. You have to repay the amount with interest and other charges.

Applying for a credit card online is easy in 4 simple steps on Yoindia as follows:

How to apply online on a bank website?

Every bank has a different application process; you can visit the bank website. OR You can easily apply for a credit card on Yoindi as it has ties up with many banks.

The following are the tips for using a credit card in the right manner

If you have multiple credit cards, you must use the right card for the right thing. For example, traveling uses travel benefits cards, and to get reward points to use credit cards that provide reward points.

During the emergency period, convert your unutilized credit limits into personal loans at nominal interest. This helps you to meet your urgent needs in no time.

Convert your purchase into EMI to repay the bill at your need and convenience.

Credit cards provide you 2x rewards points when you make online purchases, so make use of it.

You can redeem the rewards points and get discounts on hotel bookings, flight tickets, shopping, etc. These reward points provide you with cashback, recharge vouchers, and shopping vouchers.

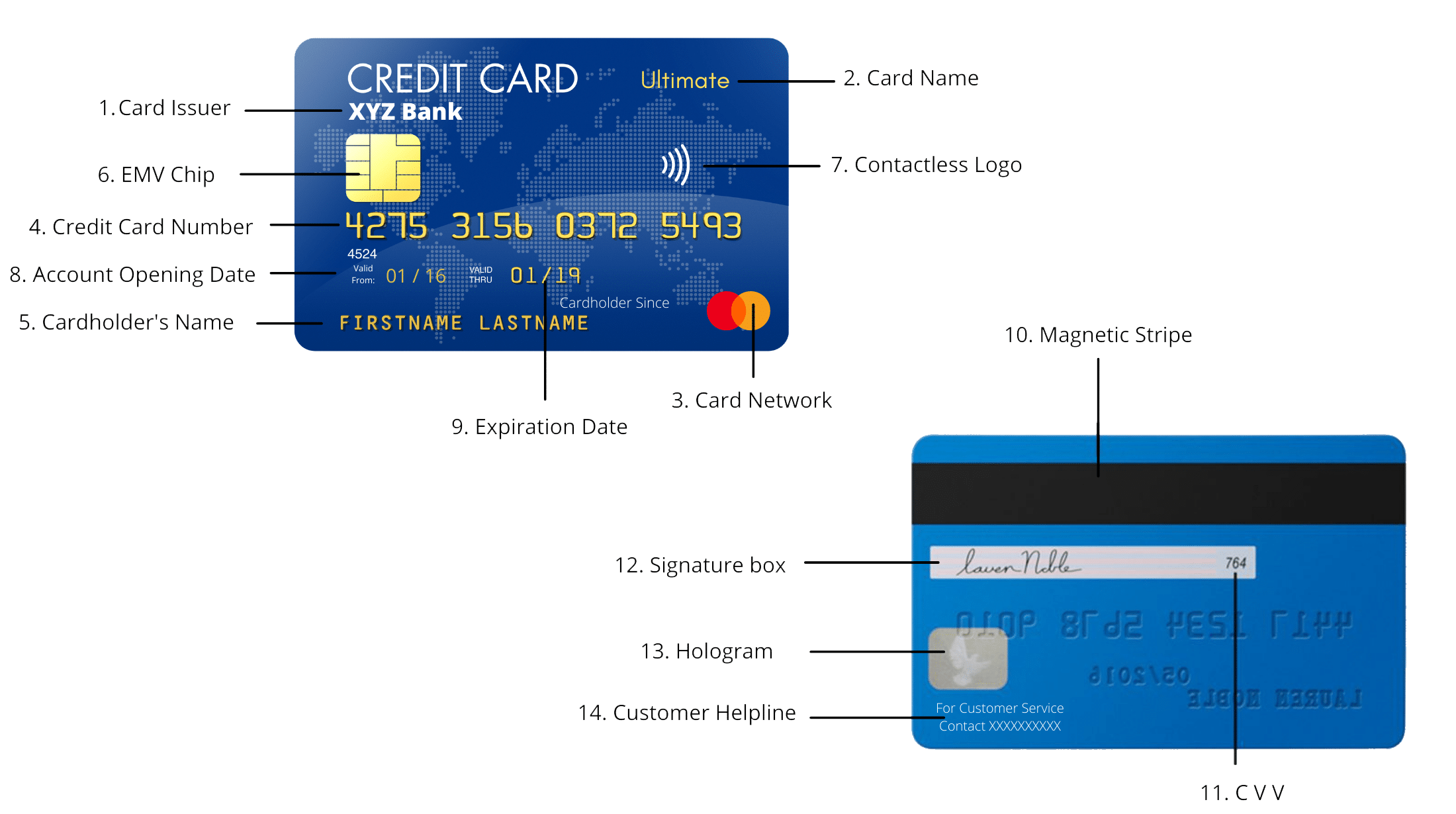

The credit card size is round corners with a radius of 2.88 - 3.48 millimeters, and most credit cards are 85.60 by 53.98 millimeters.

Credit card is printed, Complying with ISO/IEC 7812 numbered Standard. With the help of the beginning digits of the Bank Identification Number, a bank name can be identified.

The Credit card has a magnetic stripe conforming to the ISO/IEC 7813. Modern Credit cards use smart card technology, as they are computer chips for security purposes. Additionally, a fingerprint sensor is inserted in the credit card.

The Credit card consists of issues and expiry date on it. Also, it consists of 16 digits. The first 6 digits denote bank numbers, 7- 15 numbers denote account numbers, and the last digit is a check Digit.

The credit card came into the picture in 1887 by Edward Bellamy. Bellamy uses a credit card eleven times in the novel. The origination of credit cards during the 1920s in the United States. In India, The Central Bank of India launched the first bank credit in 1980. After that, Andhra bank launched the credit card Visa Card.

In 1988 to 1993, a lot of Public sector banks started issuing credit cards to their customers. During the same time, ATMs have gained popularity. Credit card is accepted due to shopping and better product offer in a competitive landscape. A large number of people were aware of credit cards and debit cards till the 1990s.

To keep your account in good standing, you must pay a small amount each month.The statement balance is the total balance of billing. The existing balance is the total amount of your recent bill and recent charges.

The interest is charged on the balance amount of the due date each month. When you are carrying the balance month to month, then charges take place on a daily basis.

The period between the end of the billing cycle and the date payment is due is a grace period. You do not have to pay charges on the balance till the due date arrives. It is a minimum of 21 days.

The disadvantages such as high-interest charges, risk of fraud, and overspending by cardholders. Additionally, expenses such as annual fees, fees of foreign transactions, and expenses on cash withdrawals. It has hidden costs such as joining fees, late payment fees, renewal fees, and processing fees.

They are following ways you can increase your credit card limit

When you are transferring the amount, you owe from one card to another card. You are doing this to maintain your CIBIL score. Various banks offer this facility. The banks such as SBI, HSDBC, Axis Bank, Kotak Mahindra bank, etc.

There are two modes by which you can repay your credit card bill.

Suppose you don't have a job but generate income from other sources. The sources such as mutual funds, professional fees, and others you will get credit cards. The card issuer will check your CIBIL score.

The card provider decides the credit card limit. It is the maximum amount cardholders can spend. The credit limit depends on your income, credit score, and credit history.

There are two methods to repay a credit card bill.

When you have an urgent need for money, then various banks provide you with a loan against a credit card. The loan is given based on your credit limit. Bank takes charge of you when you repay the loan amount.

When you have to open an account, you have to deposit the money with the credit card issuer is a secured credit card.

You can convert credit card purchases into EMIs during the time of purchase itself.

It defines how much credit you are using that is available to you. It revolved around credit accounts like credit cards, home line equity of credits, and personal line of credit.

Some the credit card providers allow customers to convert reward points to cash. If you have issued a credit card from them, you can convert reward points to cash.

You must check your eligibility criteria to get a credit card for the first time. The criteria are having a 750 or more CIBIL score and having a regular source of income.

You have to make a small monthly purchase from your credit card. When you are not using it for continuous periods, it incurs additional charges for you.

The minimum credit score for a credit card is 750, generally. However, this criteria varies from provider to provider.

You can apply for multiple credit cards simultaneously, as each application is reviewed separately.